Interest in, and concern with, the range of issues encapsulated in the term ‘ESG’ (Environment, Social, and Governance) is continuing to increase, throughout the developed world and beyond.

Much of the focus to date has been on ‘E; but ‘S’ and ‘G’ too are now fast gaining traction, intensified by the COVID-19 and other events of the past two years. The momentum for social comes from increasing recognition of growing inequality in our societies; pressure on governance arises from our recognition of the role that technology and data have played in driving those inequalities, and from increased regulatory activity in response.

Data privacy is an increasingly important aspect of governance as both populations and governments focus their attention on a corporation’s responsibilities in a social context. This, in turn, places greater emphasis on fiduciary duty and the governance role of corporate boards in understanding and mitigating harm to all stakeholders.

ESG concerns are driving fundamental change in the investment world with a move towards responsibility in its stewardship of investor money, with investors seeking to understand how their savings are being invested. Indeed, some 75% of portfolio investors reportedly already factor in ESG into their investment process and in July 2020 alone, assets in globally listed ESG, ETF’s and ETPS’s increased from $88bn to $101bn with 51.6% of those assets accounted for by European-domiciled ESG vehicles and 40% US domiciled.

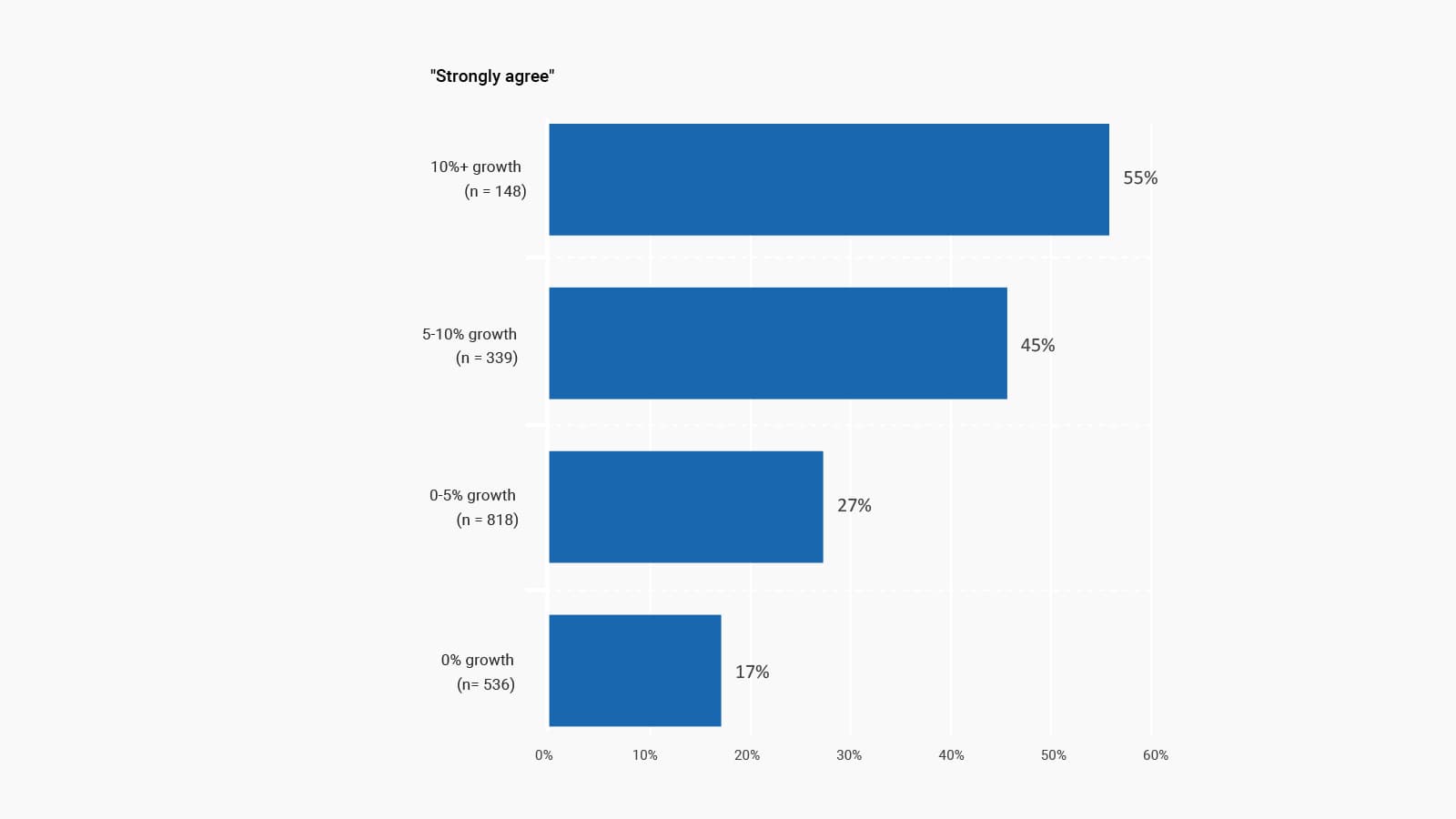

Research by Securys and others demonstrates that companies with good ESG practices rate higher, perform better and outperform the market. A study by Deutsche Bank of 56 academic studies found that 89% of them showed that companies with high ESG factors outperformed the market in the in the medium (3-5 years) and long term (5-10 years) whilst according to Harvard Business School, companies that implement ESG typically perform 4.8% better than those that don’t.

When it comes to the end users of VC portfolio companies’ products and services, the purchasing decisions of customers (especially millennials) are increasingly ESG values-driven.

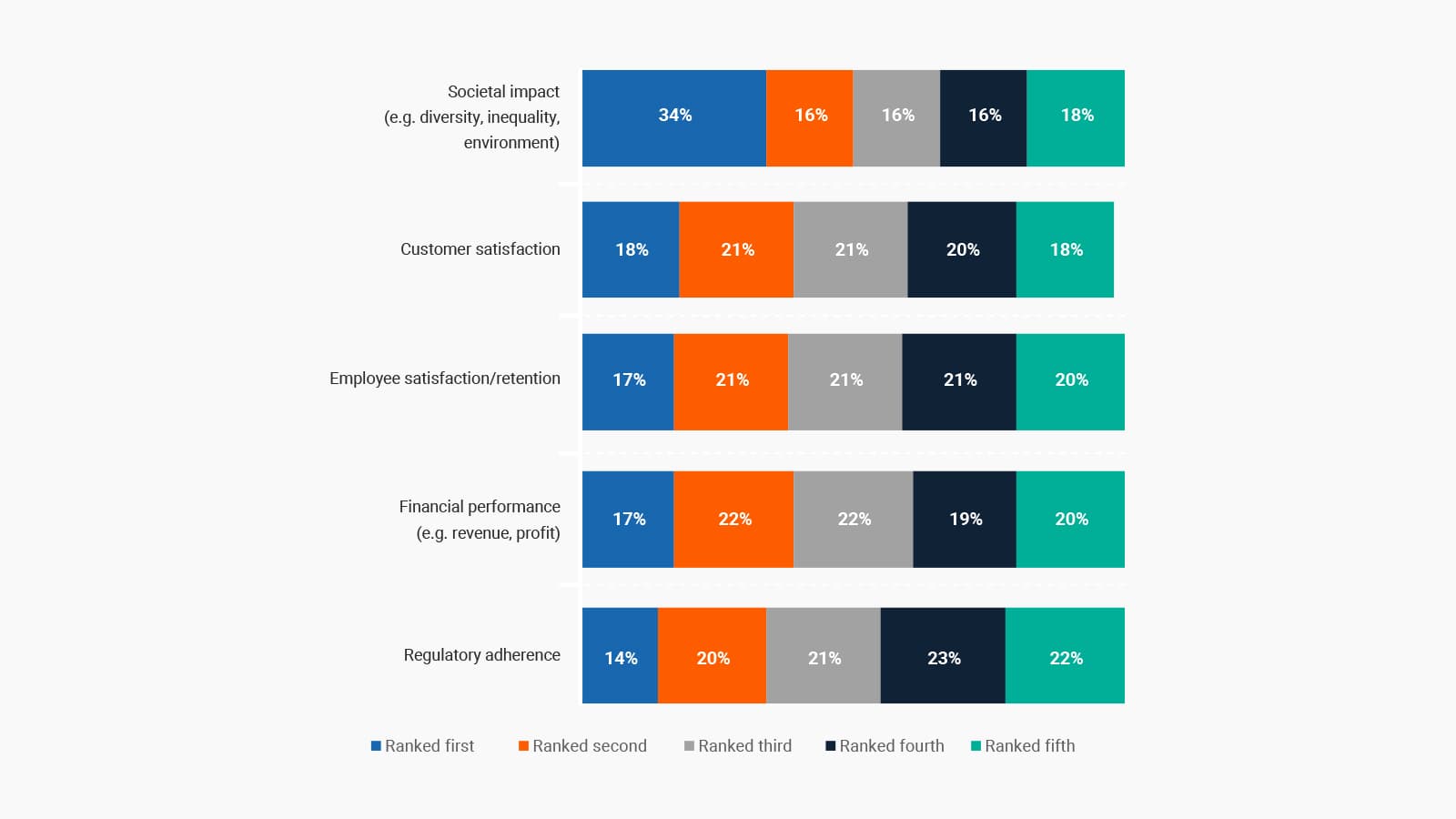

Recent data from Deloitte indicate that social impact has been rated the most important factor in assessing a firm’s annual annual performance, and by some margin over customer satisfaction, employee satisfaction/retention, then financial performance (see below). Moreover, in this same study, 53% of respondents said that they had created new revenue streams from socially-conscious offerings.